People use these loans for medical consultations or urgent personal travel. Plenty of individuals believe that they capitalize on of low-income people economic difficulties. Utilized correctly, discovered that be fairly inexpensive.

Fast Paycheck Loans are popular these days. Why? There will come a time in your life where you will be in desperate need of money but will be caught in between paydays. In fact, you might have experienced it before. If you did, then you know how this can really frustrate someone. So, how will you be able to raise the money you need urgently if your payday is still two or three weeks away? But be aware because you need fast cash many sources will take advantage of you charging you outrageous rates.The best answer to the above question would be getting fast paycheck loan.As a Financial Consultant I have found this fast paycheck loan service to be reputable.

Don’t fret. With fast payday loans, you can get additional money within the same day. All you have to do is go online, browse through reliable payday loans companies that your family and friends recommended, and file your application. Presto! You have payday loans deposited directly to your bank account in a matter of hours. Tiffany, here you come!

That’s right, no interest. I was looking for payday loan marianna florida on the web and nearmeloans and hundreds of others popped up. Due to the short terms of these payday loan marianna florida, fees aren’t generally collected through interest. Instead they have easy to understand fees that are quickly repaid.

Before giving a lender access to your personal information, ensure you are dealing with an honest company. Read reviews on their service before getting involved with them. Also, be sure that you can easily locate the site’s privacy policy.

In exchange for the loan you write the company a post dated check for the date you will pay back the loan. In most cases, the longest period is two weeks or until your next payday. Interest on these loans is usually about 15% meaning that if you borrow $100.00 you write the post dated check for $115.00. However, some of these loans in some states have been known to charge much higher interest rates so make sure you find out what the interest rates are before applying for one of these loans. If you can’t pay the loan when it comes due you may be able to roll the loan over to the next payday for another $15.00 interest rate. Which means that you will want to pay one of these loans off as fast as possible to keep the interest from adding up.

Payday cash loans are one of the fastest growing segments of the financial industry. The current financial climate means that more and more people are living from paycheck to paycheck with little savings. When an emergency happens, and they need immediate cash, they have no cash cushion or savings to borrow against. Enter the new world of fast payday cash loans.

Apart from being widely and easily available cash loans, payday cash advances have many other advantages. The loans are very popular but have a few disadvantages also. Have a look at the pros and cons of fast payday loans.

Payday cash loans are small, short-term personal loans that are extended with no collateral or security deposits. This differentiates them from pawn shop loans, which require that a borrower secure a loan of cash with an item of equal or greater value.

Most lenders pledge to be a responsible lender. They display a statement highlighting this fact. Check it out and see how they are committed to responsible lending.

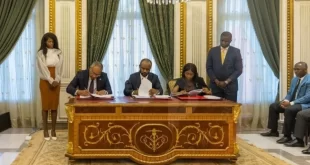

Ministerio de Minas e Hidrocarburos MMH

Ministerio de Minas e Hidrocarburos MMH